In Q4 2014, the domestic pyridine

supply declined. It's expected that the price of niacinamide (vitamin B3) would

go up in 2015.

In Q4 2014, the domestic pyridine supply

reduced, mainly because operating rate in pyridine industry dropped

dramatically. It is known that the operating rate of Chinese pyridine industry

was merely about 50% by the end of 2014, while that of 2013 almost reached

100%. The low operating rate in the industry was influenced by paraquat market.

According to the No. 1745 announcement jointly released by the Ministry of

Agriculture, the Ministry of Industry and Information Technology, General

Administration of Quality Supervision, Inspection and Quarantine of the

People's Republic of China, starting from 1 July, 2014, the registration and

production permit of paraquat AS were revoked, and the production of paraquat

AS was stopped.

Only the registrations for exporting

paraquat AS were maintained and the production exclusively for export would be

allowed. Paraquat is pyridine’s downstream market, the decreasing downstream

demand led to low upstream operating rate. Chinese 3-methylpyridine (an

important intermediate of niacinamide) was mainly supplied by pyridine

enterprises, whose declining operating rate resulted in the shortage of

3-methylpyridine supply. At present, the domestic pyridine capacity amounted to

12,000 t/a. Calculated as the output ratio of pyridine and 3-methylpyridine,

the capacity of the domestic 3-methylpyridine is about 40,000 t/a.

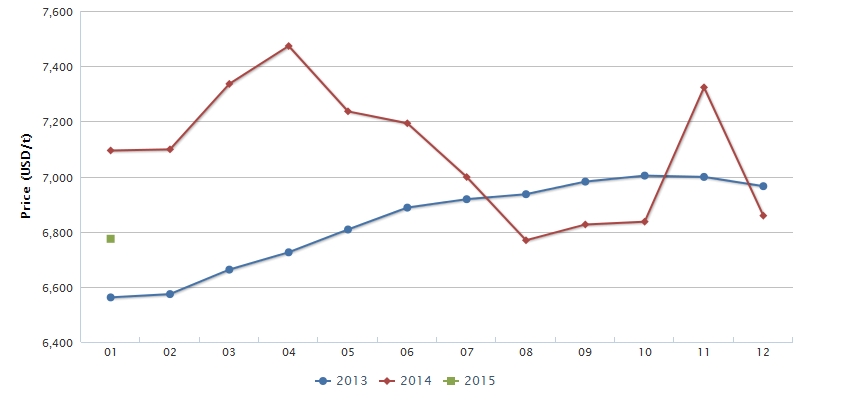

Market price of niacinamide in China, 2013-Jan. 2015

Source: CCM

It is worth mentioning that the

anti-dumping measures against pyridine had a certain impact on its supply

decrease. On 21 Nov., 2013, China imposed anti-dumping tax against pyridine

manufactured in Japan and Indonesia, whose rate was from 24.6% to 57.4% within

five years. High tax rate led to decreasing imports. Therefore, the declining

import volume worsen the decrease of the domestic pyridine supply.

In 2015, the domestic pyridine supply will

continue to decrease, which might probably have an influence on the output and

price of niacinamide.

For one thing, raw material supply was

limited, so the domestic niacinamide output might go down. In fact, it is

anticipated that the global niacinamide capacity is about 95,000 t/a in 2015

(under the circumstance that no manufacturer puts into production). Hereinto,

the capacity of Chinese niacinamide is around 45,000 t/a, an increase of 5,000

t/a compared with that of 2013. Plants of Lonza Group and Vertellus Specialties

Inc. (Vertellus) in China successively expanded production and put into

production, respectively reaching 25,000 t/a and 5,000 t/a. In 2015, the

dramatic increasing capacity of Chinese niacinamide should have driven up its

output. However, the decreasing supply of 3-methylpyridine lowered the

operating rate; and hence, niacinamide output was restrained. For another,

soaring raw materials price drove up production cost.

The shrinking output and rising cost of

niacinamide are likely to push up its price. On 26 Jan., 2015, niacinamide

quotation was raised by 15% by Vertellus in advance, and so was

3-methylpyridine. At present, even though other domestic manufacturers have

intention to raise price, price won’t increase that much in short term for the

excessive supply over demand.

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: niacinamide